Time doesn’t wait, and neither do life’s unexpected moments. Taking action today is the only way to ensure your family is cared for tomorrow.

Legal Planning That Grows With You.

Our Focus Areas in Estate Planning:

Estate Planning • Generational Wealth Planning • Probate • Trust Administration • Conservatorships • Special Needs Planning

“Give your loved ones authority—not obstacles—when life takes a turn.”

What is Estate Planning?

It’s a way of putting your heart and intentions into a plan that safeguards your home, your hard-earned finances, and your family’s future.

Why Estate Planning Really Matters

A well-designed estate plan ensures your assets transfer privately and quickly to your loved ones without probate, and with the right protections, can also provide divorce protection, creditor protection, and long-term security for your children.

Plan it

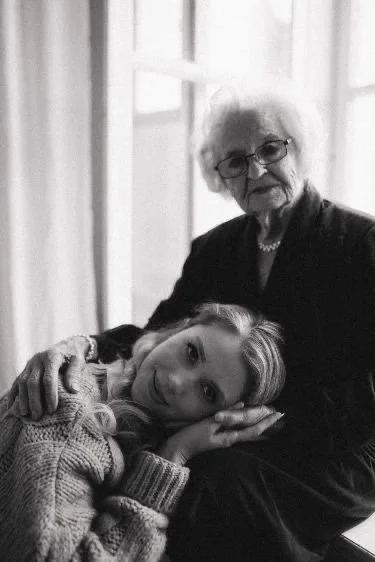

Estate planning isn’t only for the end of life—it’s for the years you’re still active, vibrant, and enjoying everything you’ve worked for. But life can turn quickly: a fall, an illness, or early memory changes that affect your ability to manage finances or make safe decisions. With the right plan, your partner can step in with clarity and love, not fear and uncertainty.”

When life becomes unpredictable, having the right documents prepared means your loved ones won’t have to guess, struggle, or turn to the courts for help. They’ll know exactly how to support you.

A complete estate plan consists of several key legal documents. Each one plays a specific role in protecting your home, finances, and family—both during your lifetime and after you pass away.

Your Living Trust

A Living Trust is the central document that holds and manages your assets. Anything placed in the trust transfers to your beneficiaries without probate, avoiding court delays and costs.

Why it matters: If you own a home in California, a Living Trust saves your family from probate, which can cost $15,000–$50,000+ and take up to two years.

Advanced Health Care Directive

This document outlines your medical wishes and appoints someone to make health decisions for you if you cannot speak for yourself.

Why it matters: If you’re unconscious after an accident, your chosen person—not the hospital—controls your treatment decisions.

Nomination of Guardian

This document allows you to name who will care for your minor children if something happens to you. Without it, the court—not your family—will decide who raises your children.

Why it matters: If you pass away unexpectedly, the court will honor your chosen guardian instead of leaving the decision to strangers or causing family disputes.

Pour Over Will

Your Will directs that any assets not already in your trust be transferred into the trust when you pass. It works as a safety net for anything unintentionally left out.

Why it matters: If you forget to title a new bank account in your trust, the Will ensures it still goes into the trust and to the right people.

Certification of Trust

A short document summarizing your trust, used by banks and financial institutions instead of providing your full private trust.

Why it matters: When opening or changing accounts, you can protect your privacy by sharing this simple certificate instead of the full trust.

Community Property Agreement

For married couples in California, this clarifies how assets are owned and can provide major tax benefits—such as a double step-up in basis—and ensures proper handling inside the trust.

Why it matters: If one spouse passes away, proper community property classification can reduce capital gains taxes when the surviving spouse sells the home.

Durable Power of Attorney

A Durable Power of Attorney gives someone you trust the legal authority to manage your finances if you become unable to do so yourself.

Why it matters:If you suffer a medical emergency, your agent can pay bills, manage accounts, and handle financial matters without needing a court-ordered conservatorship.

Assignment of Assets

This transfers your personal property—furniture, jewelry, business interests, and miscellaneous assets—into your trust to ensure everything is properly covered.

Why it matters: Even if you forget to update certain items later, the Assignment ensures your personal property is still legally part of your trust.

Once the core documents are in place, many families choose to take the next step and create a plan that reaches further.

With the right structure, you can protect what you’ve built from unnecessary taxes and future risks, while ensuring your wealth supports your children, grandchildren, and the generations that follow.

It’s a way to preserve your hard work and give your family a foundation that lasts long after you’re gone.

Legacy That Lives Forward

Beyond the basic plan, you have the opportunity to build something even more lasting. Our firm offers generational wealth planning that protects your assets as they move from one generation to the next, keeping them safe from taxes, creditors, and life’s unexpected turns. It’s a thoughtful way to let your legacy travel farther than a single lifetime.

Discover how generational planning can strengthen your family’s future.

No Estate Plan?

That’s exactly when PROBATE begins. I’m here to make the process clearer and easier for your family.

When there’s no plan, the court takes over—let’s make sure your family never has to go through that.

We can help you through every step!

What is Probate?

The hidden challenges no one warns you about…

It’s Expensive

Probate in California isn’t based on how complicated your estate is—it’s based on a statutory, court-mandated fee that is the same no matter which attorney you hire. Every attorney and every administrator receives the exact same amount under the law.

For example, if someone passes away owning a $1,000,000 home and $50,000 in the bank, the court counts the full $1,050,000 toward probate fees.

Under California’s statutory formula, the attorney would receive about $23,500, and the administrator would receive the same, totaling around $47,000—all paid out of the estate before the family receives anything.

Your Family Can’t Access Funds or Make Decisions Right Away

Bank accounts may be frozen, property can’t be sold, and even simple tasks—like paying the mortgage or handling bills—may require court approval, leaving your family stuck when they need help the most.

If your loved ones need to sell the house, they can’t do it until the court gives them permission, which can take months. And before any money is released during probate, everything must first go through the court—every step, every asset, every dollar.

Probate happens when someone passes away and the court has to step in because nothing was set up to transfer their assets smoothly. It’s the court sorting out what they owned, who should receive it, and who’s in charge—often with a lot of paperwork along the way. For most families, it becomes one more difficult thing to handle during an already emotional time.

It Takes a Long Time

The process moves slowly, sometimes months, sometimes a year or longer, leaving your family waiting before they can access anything or make important decisions. Even simple actions—selling a home, paying bills, closing accounts—often require court approval, which can delay everything further. During this time, your family is stuck watching the court’s calendar instead of moving forward with healing and closure.

It Adds Stress During an Already Hard Time

Probate often shows up when families are grieving, turning simple tasks—like paying bills or accessing accounts—into a maze of court steps and waiting periods.

For example, your family may need to pay your mortgage or property taxes right away, but the bank won’t release funds until a judge signs off—forcing them to cover expenses out of pocket during an already painful time.

Instead of focusing on honoring your memory or supporting one another, they’re forced to deal with paperwork, deadlines, and legal requirements. It becomes one more burden during a time when they’re already overwhelmed.

It Becomes Public

Everything filed in probate becomes part of the public record—your assets, debts, and even family details—meaning anyone can look them up.

The court also requires a public newspaper publication announcing the probate case so creditors can come forward and make claims.

Probate is designed to protect creditors first, not families!

Your loved ones must wait while lenders, medical providers, and anyone owed money get the chance to be paid before inheritance is released.

It Can Create Family Tension

When the court gets involved and everything takes time, disagreements can surface, and even close families can feel strained or confused about what’s happening. Misunderstandings grow easily when communication moves through lawyers and court filings.

For example, one sibling may want to sell the home to cover expenses while another wants to keep it—but neither can move forward without court approval, causing frustration and misunderstandings.

What could have been quiet, private decisions suddenly becomes a long, emotional process that can pull family members in different directions.What could have been quiet, private decisions suddenly becomes a long, emotional process that can pull family members in different directions.

Your Story

When probate becomes part of your story, we’re here to bring clarity and support. Call us to get answers, guidance, and a clear path ahead.

We do Trust Administration

While probate can be long, expensive, and public, administering a trust is usually the opposite—private, faster, and far less stressful for the family. When a loved one leaves a well-prepared trust, our role shifts from navigating court procedures to helping you carry out their wishes with clarity and care. This is where trust administration begins.

What is Trust Administration?

When someone passes, their trust becomes their voice. Administering it with care honors not just their wishes, but their love.

Trust Administration begins when someone passes away and their trust needs to be managed, settled, and distributed.

Our Trust Administration Services

This process includes handling bank accounts, real estate, taxes, creditor notices, beneficiary communications, and ensuring all steps required by California law are completed properly. Although trust administration does not involve the court like probate does, it still carries serious legal responsibilities for the trustee.

-

Flexible, expert advice when you need it. Book hourly support across a range of topics—from planning to problem-solving. This focused consultation will help clarify your goals, map out next steps, and identify opportunities for growth.

-

Flexible, expert advice when you need it. Book hourly support across a range of topics—from planning to problem-solving. This focused consultation will help clarify your goals, map out next steps, and identify opportunities for growth.

-

Flexible, expert advice when you need it. Book hourly support across a range of topics—from planning to problem-solving. This focused consultation will help clarify your goals, map out next steps, and identify opportunities for growth.

Life brings moments when someone can no longer make decisions on their own. That’s when a CONSERVATORSHIP steps in, when the court chooses someone to care, to manage, to guide. It’s a heavy responsibility, and one no family hopes to face unprepared.

Facing a conservatorship? Let us help you move forward with clarity.

Whether this is a sudden crisis or a long-building concern, we’ll walk you through the entire conservatorship process with care. From determining what type of conservatorship is appropriate to preparing paperwork and guiding you through court, we make each step manageable.

What is a Conservatorship?

A Conservatorship is a court process that steps in when an adult can no longer make safe decisions about their money, health, or daily life—whether because of dementia, Alzheimer’s, a stroke, a sudden disability, or when a child with developmental disabilities reaches adulthood and still needs support. Without the right legal documents in place, even a loving spouse or parent can’t automatically step in to help. In those moments, the court must choose someone to take on that role as Conservator.

What Kind of Conservatorship Might Be Needed

Every family’s situation is different, and the court considers what level of support your loved one truly needs. Here are the ways a conservatorship can be set up in California to match those needs:

Conservator of the Person

This conservator makes decisions about medical care, daily living needs, and personal well-being.

Example: An elderly parent with dementia may need help choosing doctors, managing medications, or ensuring they live in a safe environment.

Limited Conservatorship

Designed for adults with developmental disabilities, giving the conservator only the powers the person genuinely needs while preserving independence and dignity.

Example: A young adult with autism may be capable of living independently but still need help signing contracts or managing finances.

Conservator of the Estate

This conservator manages finances—paying bills, handling bank accounts, protecting assets, and preventing misuse of money.

Example: A stroke survivor who can no longer safely manage mail, bills, or financial decisions may need someone to oversee their finances.

General Conservatorship

Used when an adult cannot manage personal or financial decisions due to age, illness, cognitive decline, or disability. It gives broad authority to the conservator.

Example: A parent with advanced Alzheimer’s who can’t safely care for themselves or manage money may need full support under a general conservatorship.

LPS Conservatorship

We know how heavy this responsibility can feel. Our role is to lighten the burden—guiding you, supporting you, and ensuring every legal step is handled with care and attention.

Temporary Conservatorship

Granted when immediate protection is needed—usually during a crisis—until the court can hold a full hearing.

Example: If someone becomes suddenly incapacitated after an accident or medical emergency, a temporary conservator may be appointed so urgent medical or financial decisions can be made.

Reserved for adults with serious mental health conditions who cannot recognize their need for treatment. It allows a conservator to work with doctors in arranging psychiatric care and housing.

Example: An adult child experiencing severe psychosis who is unable to care for themselves or accept treatment may need this level of structured support

Special Needs Trust Planning

“Caring for someone with special needs isn’t just about today—it’s about all the tomorrows you may not be here to see. A Special Needs Trust becomes the gentle hands that continue the care, ensuring they’re provided for without losing the vital benefits that help them thrive.”

.

A Special Needs Trust is one of the most important ways to protect a loved one with a disability. It allows you to set aside money for their future—covering housing, therapy, education, caregiving, transportation, and other quality-of-life needs—without jeopardizing important government benefits like SSI or Medi-Cal. Since these programs have strict asset and income limits, leaving money to your loved one directly could unintentionally disqualify them. A Special Needs Trust keeps their benefits safe while still providing long-term financial support.

A lifetime of support for the person who needs it most.

We Are Here

Beyond financial protection, this type of trust brings peace of mind. It ensures that your loved one will always have someone managing funds responsibly, advocating for their needs, and providing continuity of care long after you’re gone.

Our goal is simple: to help you create a plan that protects your loved one today and gives them security, stability, and dignity for the rest of their life.

Different Ways to Protect a Loved One with Special Needs

First-Party (Self-Settled) Special Needs Trust

Funded with the beneficiary’s own money—often from a personal injury settlement, an inheritance received directly, or assets in their name. It protects benefits but requires that any remaining funds repay Medi-Cal when the beneficiary passes.

Example:

A young woman with a developmental disability receives a large settlement after an accident. To keep her Medi-Cal and SSI, her parents place the settlement into a First-Party Special Needs Trust so it can be used for her care without losing benefits.

Pooled Special Needs Trust

Managed by a nonprofit organization, this trust “pools” the funds of many beneficiaries for investment purposes while keeping everyone’s money in separate accounts. It’s often a good choice when the amount being set aside is modest or when no family member is available to serve as trustee.

Example:

An older adult with a disability inherits a small amount from a relative. His sibling places it into a Pooled Special Needs Trust run by a nonprofit, ensuring it is properly managed and preserved for his benefit.

Third Party Special Needs Trust

Created and funded by someone other than the person with the disability—usually a parent, grandparent, or relative. This trust allows you to set aside money for future care, therapies, education, housing support, and quality-of-life expenses without affecting benefits.

Example:

A mother wants to make sure her adult son with autism is cared for after she’s gone. She sets up a Third-Party Special Needs Trust so her savings and life insurance can support him without disrupting his SSI or Medi-Cal.

Minor’s or Standalone Special Needs Trust for Future Planning

Parents can create a Special Needs Trust while their child is still young to ensure future inheritances, gifts from family, and life insurance proceeds flow into the trust—not directly to the child. This protects benefits when they reach adulthood.

Example:

Parents of a 10-year-old with Down syndrome set up a Special Needs Trust so that grandparents’ gifts and the parents’ future estate all support their child safely without affecting eligibility for benefits later.

Special Needs Planning Services

We guide families through every step of Special Needs Trust planning. This includes:

Explaining the different types of Special Needs Trusts (First-Party, Third-Party, Pooled Trusts) and which one fits your situation

Drafting a customized trust that meets California and federal rules

Coordinating with financial planners, care coordinators, or family members

Helping you structure your overall estate plan so money flows into the trust the right way

Ensuring the trust is set up properly to preserve SSI, Medi-Cal, and other benefits

Providing ongoing guidance as your loved one’s needs change

“If you don’t choose who speaks for you, life will choose for you—and it may not choose kindly.”

Durable Power of Attorney

Assignment of Assets

This transfers your personal property—furniture, jewelry, business interests, and miscellaneous assets—into your trust to ensure everything is properly covered.

Why it matters: Example: Even if you forget to update certain items later, the Assignment ensures your personal property is still legally part of your trust.

Because their care shouldn’t end when you’re no longer here.

We guide families through every step of Special Needs Trust planning.

Supporting Estate Planning Documents

Included With Your Plan

Certification of Trust

Legacy & Generational Wealth Planning

For married couples in California, this clarifies how assets are owned and can provide major tax benefits—such as a double step-up in basis—and ensures proper handling inside the trust.

Why it matters: Example: If one spouse passes away, proper community property classification can reduce capital gains taxes when the surviving spouse sells the home.

“When someone passes, their trust becomes their voice. Administering it with care honors not just their wishes, but their love.”

“Putting your wishes in writing isn’t paperwork

—it’s love, protection, and peace for the people you trust.”

We do Trust Administration.

You’ll have steady guidance so you never feel like you’re navigating this alone.

What is Trust Administration?

Trust Administration begins when someone passes away and their trust needs to be managed, settled, and distributed.

How does the process work?

This process includes handling bank accounts, real estate, taxes, creditor notices, beneficiary communications, and ensuring all steps required by California law are completed properly. Although trust administration does not involve the court like probate does, it still carries serious legal responsibilities for the trustee.

We can step in as soon as someone passes away

We guide your family through every step of a Conservatorship—handling the court paperwork, coordinating medical capacity evaluations, appearing at hearings, working with court investigators, and managing required accountings so you are never navigating the process alone.

Can a Trustee Handle This Without an Attorney?

“When life shifts and responsibilities change hands, the right plan ensures your family is never left guessing about what comes next.”

A Durable Power of Attorney gives someone you trust the legal authority to manage your finances if you become unable to do so yourself.

Why it matters: Example: If you suffer a medical emergency, your agent can pay bills, manage accounts, and handle financial matters without needing a court-ordered conservatorship.

This document outlines your medical wishes and appoints someone to make health decisions for you if you cannot speak for yourself.

Why it matters: Example: If you’re unconscious after an accident, your chosen person—not the hospital—controls your treatment decisions.

Our Role in Trust Administration

As the attorney, I will guide the successor trustee through the entire process, including:

Reviewing the trust and explaining the trustee’s legal duties and obligations

Helping the trustee gather, inventory, and value all assets

Advising how to handle bank accounts, retirement accounts, investments, and real estate

Preparing and sending required legal notices to beneficiaries and heirs

Assisting with trust accounting and reporting requirements

Coordinating real estate transfers, deeds, and property tax filings

Ensuring all necessary tax returns are completed (trust, estate, property tax, income tax issues)

Protecting the trustee from personal liability by ensuring all legal deadlines and duties are met

Managing or mediating beneficiary concerns and potential disputes

Making sure all distributions follow the trust correctly and legally

In some simple cases, a trustee can manage parts of the process on their own. However, most families choose to work with an attorney because:

Trustees can be held personally liable if something is done incorrectly

Missing deadlines can lead to legal penalties

Mistakes in notices or accounting can expose the trustee to lawsuits

Real estate transfers require precise legal steps

Beneficiary disputes are easier to manage with a neutral professional

Many trustees want peace of mind knowing everything is done correctly

Most clients find that having an attorney ensures the process is smooth, accurate, and stress-free.

What is a Conservatorship?

A Conservatorship is a court process that steps in when an adult can no longer make safe decisions about their money, health, or daily life—whether because of dementia, Alzheimer’s, a stroke, a sudden disability, or when a child with developmental disabilities reaches adulthood and still needs support. Without the right legal documents in place, even a loving spouse or parent can’t automatically step in to help. In those moments, the court must choose someone to take on that role as Conservator.

Depending on the situation, the court may grant authority over personal and medical decisions (Conservatorship of the Person), financial matters (Conservatorship of the Estate), or both (General Conservatorship) for adults with dementia. Adults with developmental disabilities may receive a Limited Conservatorship, which offers support only where needed while preserving independence. In more serious mental health cases, an LPS Conservatorship may be required for a higher level of care.

For adults who may develop dementia or Alzheimer’s in the future, we can often help your family avoid Conservatorship entirely by putting the right legal documents in place while your loved one still has capacity.

“Caring for someone with special needs isn’t just about today—it’s about all the tomorrows you may not be here to see. A Special Needs Trust becomes the gentle hands that continue the care, ensuring they’re provided for without losing the vital benefits that help them thrive.”

Give your loved ones authority—not a courtroom battle—when you need help.

For adults with developmental disabilities, the process works differently: planning cannot eliminate the need, but we can help you pursue a well-structured Limited Conservatorship that provides the right balance of protection, support, and independence.

Nomination of Guardian

This document allows you to name who will care for your minor children if something happens to you. Without it, the court—not your family—will decide who raises your children.

Why it matters: If you pass away unexpectedly, the court will honor your chosen guardian instead of leaving the decision to strangers or causing family disputes.

A Special Needs Trust is one of the most important ways to protect a loved one with a disability. It allows you to set aside money for their future—covering housing, therapy, education, caregiving, transportation, and other quality-of-life needs—without jeopardizing important government benefits like SSI or Medi-Cal. Since these programs have strict asset and income limits, leaving money to your loved one directly could unintentionally disqualify them. A Special Needs Trust keeps their benefits safe while still providing long-term financial support.

Our goal is simple: to help you create a plan that protects your loved one today and gives them security, stability, and dignity for the rest of their life.

Because a properly built Special Needs Trust gives your loved one the security, support, and dignity they deserve.

Advance Health Care Directive

Community Property Agreement (where applicable)

“Some families want their legacy to last longer than one generation. With the right trust structure, you can pass wealth to your children and grandchildren without it being eaten away by repeated estate taxes. It’s how you turn what you built into long-term strength for your family.”

We can step in as soon as someone passes away, when the Families reach out to the attorney when:

They are overwhelmed and unsure where to begin

The trustee wants guidance to avoid mistakes

Real estate must be transferred or sold

There are disagreements among siblings or beneficiaries

The trustee fears being sued or held personally responsible

The trust instructions are complex or involve tax issues or property in multiple states

Conservatorships

Life brings moments when someone can no longer make decisions on their own. That’s when a conservatorship steps in, when the court chooses someone to care, to manage, to guide. It’s a heavy responsibility, and one no family hopes to face unprepared.

Special Needs Trust Planning

A lifetime of support for the person who needs it most.

Beyond financial protection, this type of trust brings peace of mind. It ensures that your loved one will always have someone managing funds responsibly, advocating for their needs, and providing continuity of care long after you’re gone.

When life changes suddenly, the right documents protect the people you love.

Imagine your mother starting to show signs of dementia—missing bills, getting confused, or struggling to make safe decisions. Without a Living Trust, Power of Attorney, or Health Care Directive, no one in your family can legally step in to help her with money, medical decisions, or protecting her from financial harm. In that moment, your only option is a Conservatorship, a court-driven process with filings, doctor evaluations, hearings, and ongoing supervision. It’s stressful, expensive, and time-consuming—which is why setting up the right documents before incapacity is one of the greatest gifts you can give your family.

We help YOU by:

Explaining the different types of Special Needs Trusts (First-Party, Third-Party, Pooled Trusts) and which one fits your situation

Drafting a customized trust that meets California and federal rules

Coordinating with financial planners, care coordinators, or family members

Helping you structure your overall estate plan so money flows into the trust the right way

Ensuring the trust is set up properly to preserve SSI, Medi-Cal, and other benefits

Providing ongoing guidance as your loved one’s needs change

A short document summarizing your trust, used by banks and financial institutions instead of providing your full private trust.

Why it matters: Example: When opening or changing accounts, you can protect your privacy by sharing this simple certificate instead of the full trust.

With a passion for transforming spaces into functional and aesthetically pleasing environments, Helen Gates is a distinguished interior designer known for her unique and innovative approach to interior design.

SERVICES

INTERIOR DESIGN

ARCHITECTURE

PROJECT MANAGEMENT

CREATIVE ADVISORY

INTERIOR ARCHITECTURE

ACCOLADES & PRESS

2023 INTERIOR DESIGN AWARD

2022 DESIGN MAGAZINE FEATURE

2022 HOME MAGAZINE feature

2019 DESIGN MAGAZINE FEATURE

2019 INTERIOR DESIGN AWARD

2018 ARCHITECTURAL MAGAZINE

2017 Decor MAGAZINE FEATURE